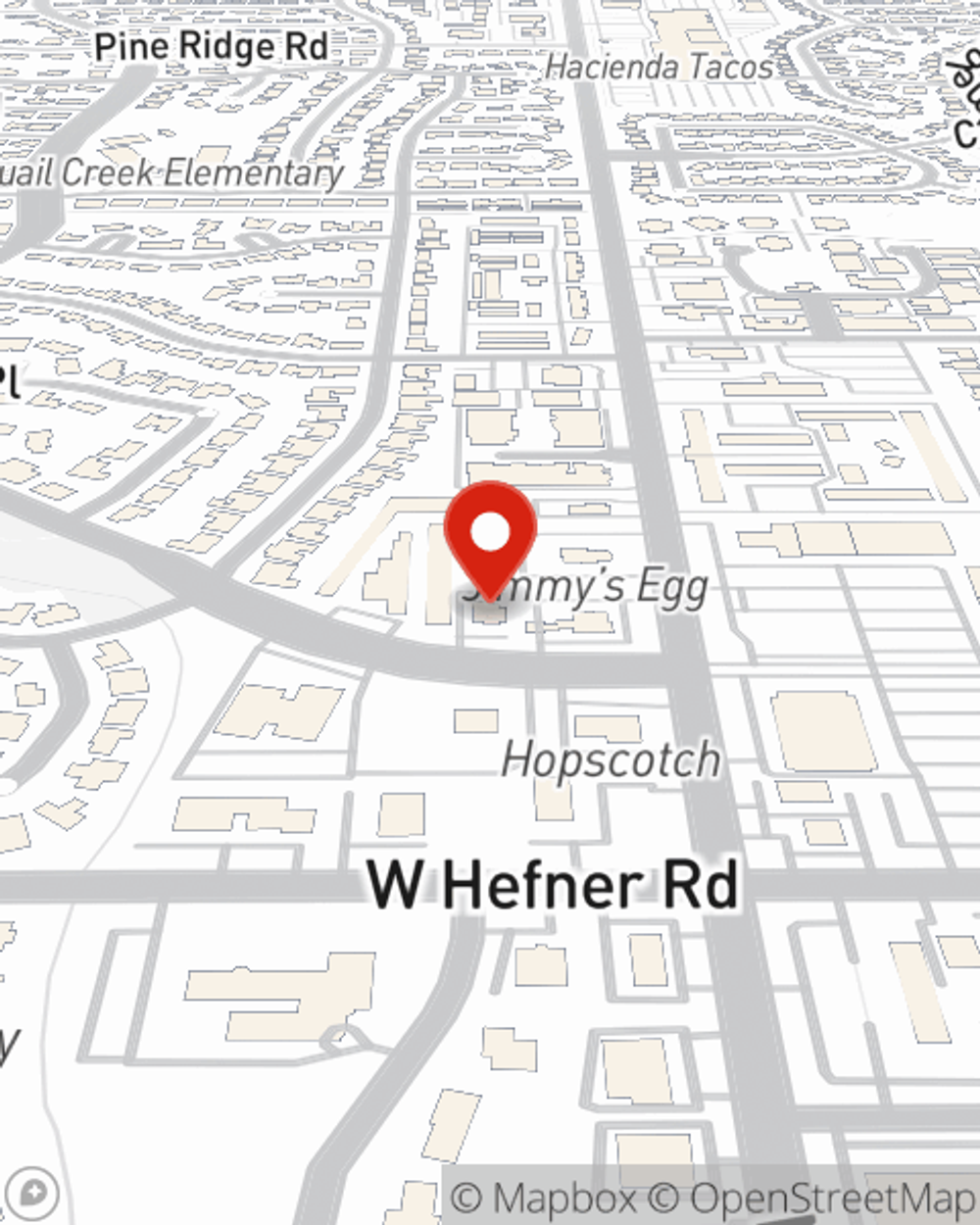

Business Insurance in and around Oklahoma City

One of Oklahoma City’s top choices for small business insurance.

This small business insurance is not risky

Cost Effective Insurance For Your Business.

Preparation is key for when a mishap happens on your business's property like an employee getting hurt.

One of Oklahoma City’s top choices for small business insurance.

This small business insurance is not risky

Protect Your Future With State Farm

Protecting your business from these potential problems is as easy as choosing State Farm. With this small business insurance, agent Rod Chew can not only help you design a policy that will fit your needs, but can also help you submit a claim should a problem like this arise.

Don’t let the unknown about your business keep you up at night! Get in touch with State Farm agent Rod Chew today, and find out how you can benefit from State Farm small business insurance.

Simple Insights®

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

Checklist for apartment renting

Checklist for apartment renting

When finding an apartment, it’s important to know what to look for so you can make a smart assessment about each property you’re interested in.

Rod Chew

State Farm® Insurance AgentSimple Insights®

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

Checklist for apartment renting

Checklist for apartment renting

When finding an apartment, it’s important to know what to look for so you can make a smart assessment about each property you’re interested in.